I hear a lot from the finance sector about applications of AI, and one seems to overlap greatly with this current fintech scenario. And there you go-a peanut butter to jelly. Nowadays, all handling of money, banking, is totally revolutionizing.

Imagine smarter chatbots that help with your banking-related questions, fraud-spotting algorithms faster than hawks, or personalized finance advice just for you-all thanks to artificial intelligence.

Let’s see some cool use cases of AI in fintech. Finance nerd or simply curious about what’s going on, let’s go ahead and check out how AI is making our financial lives really a whole lot easier and exciting!

What’s The Scoop On AI And Fintech?

Alright, let’s chat about AI and fintech—what they really mean and why they matter.

So, fintech (financial technology) is all about using technology to make the financial world a whole lot easier. We’re talking about everything from managing your money to tackling fraud and so much more.

If you think about it, just a decade ago, dealing with finances felt like a total hassle. Now, thanks to fintech companies, you’ve got a bunch of personalized options at your fingertips.

Like, have you tried chatting with an AI-powered chatbot?

These little helpers are popping up everywhere in the fintech space, lending a hand whether you’re browsing or trying to get customer support. And here’s the kicker: fintech has exploded in recent years!

Traditional banks are finally catching on to what’s happening, and they’re realizing they can’t just stick to old-school methods. They’ve started rolling out their own tech solutions too, using artificial intelligence and robotics to cut costs and make our lives easier.

In a nutshell, AI and fintech are seriously changing the way we handle money and interact with banks. It’s all about making things smoother, faster, and way more user-friendly.

Explore More: About AI Statistics

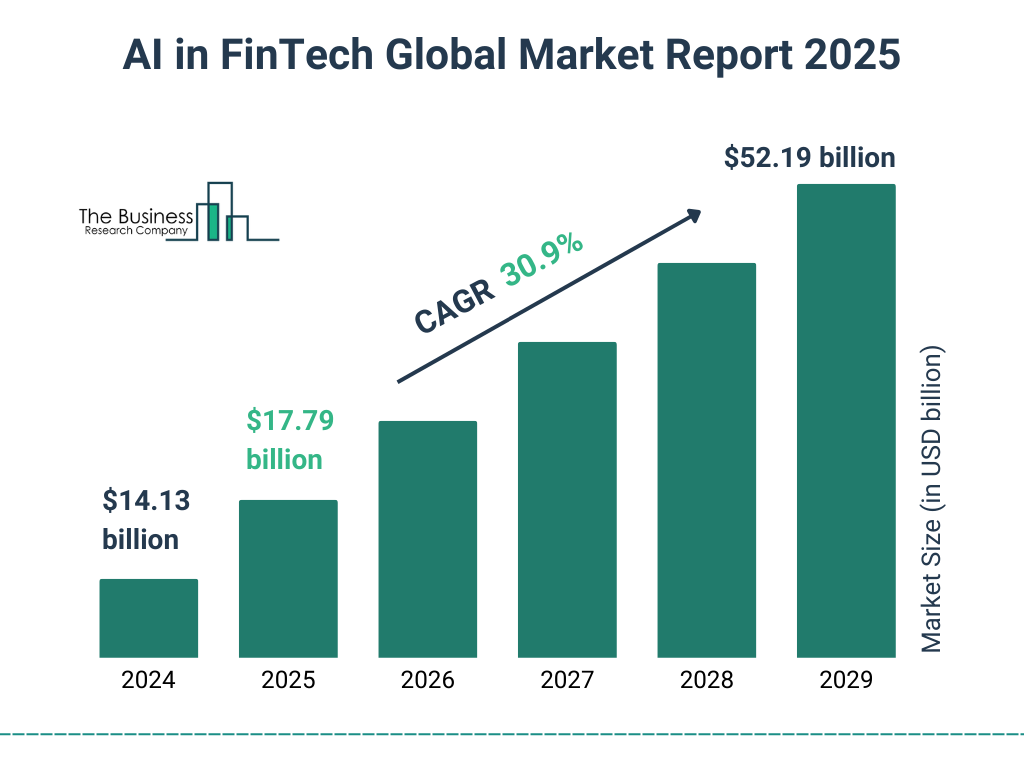

AI In Fintech Market Size Overview

- Study Period: 2019 – 2030

- Market Size (2025): USD 18.31 billion

- Market Size (2030): USD 53.30 billion

- CAGR (2025 – 2030): 23.82%

- Fastest Growing Market: Asia-Pacific

- Largest Market: North America

- Market Concentration: Low

Key Insights:

- Major Players:

- IBM Corporation

- Intel Corporation

- ComplyAdvantage.com

- Narrative Science

- Amazon Web Services, Inc.

The AI in fintech market is experiencing rapid growth, driven by increasing demand for efficient solutions in areas like fraud detection, customer support, and data analysis. With significant infrastructural investments and advancements in AI technology, the landscape is set for transformative changes and innovative collaborations among industry leaders.

Read More: AI For Marketing Analytics

Fraud Detection With AI Expected To Witness Significant Market Growth

AI’s Role:

- Leverages artificial intelligence to rapidly detect financial fraud and malpractice.

- Processes vast datasets efficiently, handling transactions and user behavior patterns to identify anomalies in real-time.

Efficiency Benefits:

- Reduces false positives, allowing experts to focus on complex issues.

- Enhances the accuracy of fraud detection compared to manual methods.

Banking Strategies Against Fraud:

- Multi-faceted approaches including:

- Encryption

- Two-factor authentication

- AI-powered anomaly detection

- Real-time monitoring

- Regular audits and staff/client education on best practices.

Diverse Fraud Challenges:

- Addresses issues like identity theft, credit card fraud, phishing, and money laundering.

- Necessitates continuous refinement of defenses against evolving fraud tactics.

Growth In AI Adoption:

- A poll by Certified Fraud Examiners (ACFE) and SAS noted a rise in AI and machine learning usage for fraud detection:

- 13% of organizations are currently using AI for fraud prevention.

- An additional 25% plan to adopt these technologies, indicating a 200% growth potential.

The Benefits Of AI for Your Business

Let’s talk about how AI in 2025 (artificial intelligence) can really shake things up for your business, especially in the world of fintech. The way AI and fintech work together is pretty remarkable, and lately, AI has been stepping back into the spotlight, bringing some personal touch back to banking that’s been a bit lost in the shuffle with all those big banks running the show.

How Can AI Boost Banks And Financial Services?

AI is transforming the banking and financial services industry, offering innovative solutions to enhance efficiency, security, and customer experience. Let’s break it down! Here are some key points to explore:

Automating Data & Credit Risk Assessment

First off, credit scoring! AI takes this to a whole new level. Not just a mere check of the credit history but actually into a series of factors including your income, job history, and spending habits that give you a tailored credit score. Thus, more people would likely get loans and finances which may have otherwise been denied to them. How cool is that?

Detecting Banking Fraud

Now, regarding the safety of your funds, AI is very helpful with smart analysis tools that keep track of transactions and flag anything suspicious. For instance, in case there is a sudden withdrawal of a large sum from a suspicious location, AI can detect that and alert human staff to take necessary actions. This way, one gets to save their money while being free from a considerable amount of time for the team.

Boost Security

AI is currently at the top with security considerations. Imagine facial recognition or fingerprint access on banking apps, which all consisted of AI. If something seems off, like a suspicious withdrawal attempt, AI can step in and stop it, so your finances are just that much safer.

Automated Customer Service

AI is also becoming a storming force in customer service. Chatbots have become a norm in fintech and answer your questions pretty speedily and efficiently. They’re available 24/7, so you get help at whatever odd hour you want, without having to wait around. Moreover, they’re learning from every interaction; the more you chat with them, the better they get at helping!

Understanding User Behavior

With AI, businesses can analyze your spending behavior to offer better services. For example, if you ask about your expenses from last month, AI can predict that you might want to know how to cut back and offer to show you tips right then and there. It’s all about making the experience smoother for you!

Financial Forecasting

Finally, its prediction of trend can be described: it can analyze patterns to give significant information on issues from exchange rates to investment options despite the poor nature of available data. Therefore, businesses would never be on a back leg with such services tailored with customer behavior understanding.

Real Applications Of AI In Fintech

AI isn’t just talk; it has some serious real-world applications in finance. Think about banks trying to figure out if someone is creditworthy. They can use AI to sift through customer data and find patterns, helping them decide on fair pricing based on risk. This means avoiding overcharging reliable customers and ensuring that those who pose a higher risk are set at the right rates.

Another game-changer is fraud detection. With digital transactions happening all the time, AI can monitor these in real-time to spot any unusual activity—like someone trying to apply for multiple loans at once. AI flags this as suspicious so that experts can focus on more serious cases rather than combing through tons of data.

And let’s not forget the customer support side. Those chatty bots that you see around? They have been designed to respond quickly to the usual questions, hence making life a little easier both for the business and you. That way, teams can take care of more complex issues while getting your answer straight away.

1. Data Privacy Woes

Challenge: Imagine a sleek new fintech app called “MoneyBuddy” that wants to gather data to better tailor its services. They dream of analyzing users’ spending habits and transaction histories. But when they dig into the rules, they realize they have to navigate tricky regulations like GDPR and CCPA, which make data collection a headache.

Potential Solution: To keep things above board, MoneyBuddy sets up a solid data governance plan right from the start. They use encryption to protect sensitive personal information and schedule regular audits to ensure they’re compliant with privacy laws. This way, they can offer personalized services without ending up in legal hot water.

2. Algorithm Bias

Challenge: Think about a traditional bank called “TrustBank” that just introduced an AI system to help approve loan applications. Excited to speed things up, they overlook that their training data comes from years of lending practices that favored certain demographics, which leads to biased decisions.

Potential Solution: TrustBank starts conducting regular checks on their algorithms to identify and fix biases. They begin incorporating diverse datasets that represent different income levels and backgrounds, ensuring that their credit scoring is fair and inclusive for everyone looking for a loan.

3. Costly Setup

Challenge: Picture a small fintech startup named “QuickFunds” eager to implement cutting-edge AI but daunted by the high costs of technology and hiring data experts. They love the idea but struggle with how to afford it all.

Potential Solution: To get around this, QuickFunds partners with an established tech company that offers AI solutions as a service. This lets them access advanced AI tools without the heavy upfront costs. They also seek out local innovation grants that could provide some extra financial support.

4. Legacy System Problems

Challenge: Let’s say there’s an old-school brokerage firm called “OldLine Investments” that wants to use AI to enhance customer interactions. Their tech is so outdated that it barely supports email, making it a nightmare to integrate new AI tools.

Potential Solution: OldLine decides to take baby steps by gradually upgrading its technology instead of trying to replace everything at once. They implement middleware solutions that allow new AI applications to work alongside their legacy systems, enabling smoother transitions over time.

5. Trust Issues

Challenge: A customer named Jamie downloads an app called “LendSmart” to apply for a personal loan. After hitting “submit,” Jamie feels uneasy about how AI will assess their creditworthiness without any human touch in the mix.

Potential Solution: LendSmart realizes the importance of building trust, so they create a friendly explainer video that walks users through how their AI processes work. They also have a support team readily available to answer questions and help users understand the AI’s role in the loan approval process.

6. Security Concerns

Challenge: During a holiday shopping rush, a fintech app called “SpendSavvy” picks up on some odd transactions—multiple simultaneous attempts to transfer large sums of money from various locations. Yikes!

Potential Solution: SpendSavvy’s AI immediately flags these suspicious activities and alerts their security team for a deep-dive investigation. They also enhance their cybersecurity by using AI to monitor transactions in real-time, enabling quick reactions to any potential threats.

7. Regulatory Maze

Challenge: A new startup called “FintechFuture” wants to launch an innovative AI feature for investment tracking, but they’re overwhelmed by the patchwork of regulations that differ from state to state.

Potential Solution: To simplify things, FintechFuture engages with compliance consultants who help them navigate the regulatory landscape. By working closely with regulatory bodies during development, they ensure their AI feature adheres to all relevant laws right from the start.

8. Lack Of Transparency

Challenge: A user named Sam gets turned down for a loan from an AI-powered platform called “QuickCash.” Confused about why, Sam receives an automated response that doesn’t really explain the decision.

Potential Solution: QuickCash kicks it up a notch by developing explainable AI models that provide clearer insights. Now, when Sam checks their status, they see a message like, “Your application was declined due to a credit score below our minimum threshold,” helping users understand the “why” behind decisions.

9. Need For Quality Data

Challenge: Consider a digital banking app named “SmartSaver” that tries to analyze user spending, but they’re working with outdated info, leading to poor recommendations for users on budgeting.

Potential Solution: SmartSaver invests in improving its data collection and validation processes, ensuring all information is fresh and accurate. They also adopt data augmentation techniques, giving AI the quality data it needs to make smart, savvy recommendations for budgeting and savings.

In short, AI is seriously revolutionizing fintech. It is not only making things safer and faster but also making the entire financial experience way more user-friendly and efficient. Sounds pretty promising, doesn’t it?

FAQ’s:

Q1: What is fintech, and where does AI come in?

Ans. Fintech refers to the application of technology in financial services. AI makes the whole system easy and smooth by automating most processes, making customer service smoother, and providing better security-all of which can help facilitate banking and money management.

Q2: What are some real-world examples of AI in fintech?

Ans. AI is used in a variety of ways, such as chatbots for customer support, fraud detection algorithms monitoring transactions, personalized banking advice based on spending habits, and risk assessment for loans. These applications work together to create a smoother experience for users.

Q3: How does AI improve fraud detection in the finance sector?

Ans. AI analyzes vast amounts of transaction data in real-time to spot unusual behavior that could indicate fraud. It helps reduce false positives, allowing bank staff to focus on more complex issues, ultimately making transactions safer for everyone.

Q4: What are the benefits of using AI for credit assessments?

Ans. AI enhances credit scoring, such as taking into account income and spending behavior rather than just credit history. This is how more people qualify for loans and credit. Borrowing is made available to a larger segment of the market.

Q5: How does AI contribute to better customer service in fintech?

Ans. AI makes it possible for chatbots that can answer a customer’s questions fast and efficiently 24/7. Not only are they able to give immediate responses but also learn from the interaction and improve responses with time.

Q6: What challenges do fintech companies face when implementing AI?

Ans. While AI has many benefits, fintech companies encounter challenges like data privacy concerns, algorithm bias, high implementation costs, outdated technology systems, and the need to build user trust. Each of these challenges requires thoughtful solutions.

Q7: How does AI help fintech companies navigate regulatory requirements?

Ans. AI can help fintech companies ensure compliance with so many regulations by automating monitoring procedures regarding adherence to specific laws like GDPR. Companies may then seek consultations from compliance experts to ensure they are on the right track.

Q8: What specific steps can fintechs take for themselves and ensure they have quality data on AI?

Ans. Fintech companies can collect and validate data to ensure the accuracy of data. Data augmentation techniques and frequent audits can be used to ensure that data is of the highest quality to be used by AI.

Q9: Will AI replace human jobs in fintech?

Ans. Not exactly! While AI automates many processes and makes them more efficient, human oversight is still needed for complex decision-making and personal customer interactions. AI is supposed to be a tool that empowers rather than replaces human roles in the industry.